Contents

If you want to discover the other candlestick patterns strategy guides, then head over here for a full list of them. The concept of these Doji candlestick patterns can be seen across different timeframes. Now, you’ll see lots of information about doji candlesticks and how to trade them but in here, I will show you how I trade using doji candlesticks.

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. If you’re interested in mastering some simple but effective swing trading strategies, check outHit & Run Candlesticks. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services includecoachingwith experienced swing traders,training clinics, and dailytrading ideas. The formation of the Doji indicates that buyers are losing their strength to keep prices higher, and sellers push prices back to the opening price. That means It’s a clear indication that a trend reversal is likely to happen.

Engulfing patterns and tweezers

There is an open, a high, a low, and a close on every candlestick. The body is the filled or hollow bar generated by the candlestick pattern. When a stock closes higher than its open, it forms a hollow candlestick.

No communication from Rick Saddler, Doug Campbell or this website should be considered as financial or trading advice. The horizontal line of the doji shows that the open and close occurred at the same level, while the vertical line represents the total trading range of the timeframe. When Gravestone Doji forms at the Top or Uptrend of a trend, it is considered as a sign of reversal of the Trend of the Market. You can trade the Doji pattern with another technical analysis tool. It’s a very profitable pattern because the market reverse is a very fast move.

- It appears when the candle has opened and closed at the same level and has moved in a very small range in between.

- The downward movement of the next candlestick will provide confirmation.

- The length of the wick mostly varies as the top primarily represents the highest price, while the lowest price is illustrated at the bottom.

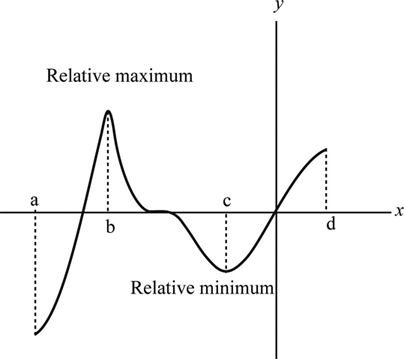

When the Gravestone Doji forms in an uptrend, it can be considered a bearish reversal pattern, especially if it forms at the resistance level or Fibonacci retracement level. Here, it could encumbrance accounting resemble a shooting star candlestick, except that it barely has a candlestick body. Similarly, for it to be a bullish reversal signal it has to appear in a downtrend, on a support level.

How Can a Doji candlestick Be Used in Cryptocurrency Trading?

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference https://1investing.in/ original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

I share my knowledge with you for free to help you learn more about the crazy world of forex trading! The appearance of the Doji can mean the trend is going to reverse from the bullish to bearish. Gravestone DojiA stop loss should be placed above the highest point of the candlestick for every gravestone doji. Doji patterns are rendered by differing positions and length of shadows, so traders have given different names to different shadow arrangements. Although doji and spinning tops share some characteristics, there are also significant differences in how technical analysts should interpret them. Investing and Trading involves significant financial risk and is not suitable for everyone.

Live Trading with DTTW™ on YouTube

This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. The Doji star can prove invaluable as it provides forex traders with a “pause and reflect” moment. While a doji is usually a sign of a reversal, a spinning top is usually a sign of continuation. The pattern tells traders that there is uncertainty in the market. That’s because there is no clear victor between buyers and sellers. It is formed when the open, high, and close prices of an asset are similar.

The dragonfly doji is a candlestick pattern stock that traders analyze as a signal that a potential reversal in a security’s price is about to occur. Depending on past price action, this reversal could be to the downside or the upside. The dragonfly doji forms when the stock’s open, close, and high prices are equal. It’s not a common occurrence, nor is it a reliable signal that a price reversal will soon happen.

How to read Japanese candlestick charts

This indicator follows the speed and momentum of the market over a specific timeframe, predicting price movements. There are different types of Doji candlesticks pattern available and be aware of them. Here you can learn how to recognize it and how to convert this into profitable trading opportunities using this pattern.What is a Doji? Doji is a candlestick patternis when the candle has the same open and closing price. Don’t make these mistakes when you trading theDoji candlestick pattern.

Triple candlestick patterns: three soldiers and crows

You may also try to check 5 minutes and 15 minutes timeframes to analyze this pattern and take your guards accordingly. After the formation of the bullish Doji Star pattern, prices begin to move up. Therefore, if you initiate trade after confirmation of this pattern, there are strong chances that you will be able to gain profit.

A doji pattern is formed when the opening and closing price are equal, or nearly equal, in value, and the high and low prices are very different from one another. The doji candlestick chart pattern is a formation that occurs when a market’s open price and close price are almost exactly the same. There are different variations of the pattern, namely the common doji, gravestone doji, dragonfly doji and long-legged doji. Candlestick charts are a unique form of trading indicators invented in 17th century Japan by rice traders.

Modern traders use a variety of candlestick patterns, among those Doji is one. It often appears during an uptrend or a downtrend, signifying equality between bullish and bearish trends. The long-legged doji is a type of candlestick pattern that signals to traders a point of indecision about the future direction of a security’s price. This doji has long upper and lower shadows and roughly the same opening and closing prices. In addition to signaling indecision, the long-legged doji can also indicate the beginning of a consolidation period where price action may soon break out to form a new trend.

Different Types of Doji Candlesticks

A Doji candlestick chart pattern is formed due to indecision in the market where neither the bulls nor bears can push prices. A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. Estimating the potential reward of a doji-informed trade also can be difficult because candlestick patterns don’t typically provide price targets.

Now, don’t worry if you don’t have the answers to these questions with regard to the doji pattern. However, using Momentum indicators could give you a clear perspective to determine the strength of a trend. A doji candle chart occurs when the opening and closing prices for a security are just about identical. If this price is close to the low it is known as a “gravestone,” close to the high a “dragonfly”, and toward the middle a “long-legged” doji. The name doji comes from the Japanese word meaning “the same thing” since both the open and close are the same.

The Dragonfly Doji is typically interpreted as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The Dragonfly Doji is created when the open, high, and close are the same or about the same price. The most reliable trading signals are generated following a strong previous trend with higher than the average volume during the doji session. It’s also a great idea to examine other technical analysis for confirmation, such as trend line support or resistance levels. For example , after a strong bearish move if series of doji candles start to appear , its an early sign that reversal may occur.

Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

Boost your trading knowledge by learning the Top 10 Candlestick Patterns. When a dragonfly Doji forms at the bottom or downtrend of a trend, it is considered as a sign of reversal of the Trend of the Market. But, at times it can happen, and then the original trend continues.

Doji represents uncertainity in the markets after a strong directional move. When the Gravestone Doji candle appears during an uptrend, it’s usually a sign of reversal—especially if it occurs near a resistance level. Alternatively, it can be interpreted as bullish when it shows up during a downtrend and hits a critical support level.